Jewellery Industry Voices' October webinar to examine the impact of online trading on the pearl sect

Trading Pearls Online: How, why, and the consequences

Thursday, October 7, 2021

9:00 AM New York, 2:00 PM London, 3:00 PM Milan, 5:00 PM Dubai, 6:30 PM Mumbai, 9:00 PM Hong Kong

Register here.

Jewellery Industry Voices' October webinar to examine the impact of online trading on the pearl sector

The COVID-19 pandemic has proven to be a watershed moment for jewellery's pearl sector, as it has for most other parts of the industry, initiating changes that most probably are irreversible. The migration to online trading of loose pearls and pearl jewellery is certainly one of them.

The pearl sector has always stood apart in the industry, and this sometimes has been to its advantage. As the producer of a biogenic jewel, as opposed to a mined gemstone, it is responsible for jewellery's only natural and precious component that is fully sustainable from an environmental perspective. It also handles a product that rarely requires substantial processing after extraction, meaning that what you see is what you get.

But it also has faced a set of unique challenges. Long susceptible to environmental catastrophe, now more frequent in these days of global warming, during the initial COVID lockdowns, pearl farms did not have the option of shutting down temporarily, as did the mines, because the damage that could have been caused to its molluscs would have been irreparable. The pearl trade has also been hamstrung by a long and convoluted supply chain, and by an abundance of different grading systems that have made the marketing and pricing of pearls a particular challenge.

The growing reliance on online trading platforms is likely to address some of the challenges, and in so doing alleviate others. Remote selling requires the development of harmonised and simplified grading systems. Trading platforms also offer practical and cost-effective ways for smaller producers and traders to communicate directly with jewellery manufacturers and even consumers, reducing their reliance on intermediaries in the supply chain. The pearl trade post-COVID is likely to be markedly different to the one that existed pre-COVID.

CIBJO's Jewellery Industry Voices webinar on October 7, 2021, will be Season 3's first exclusively online event, following the hybrid in-person-and-streamed opening of the season in Vicenza in September. Entitled “TRADING PEARLS ONLINE: Why, How, and the Consequences,” it will examine the impact of online trading in the pearl sector, discuss the particular challenges and consider how the trade is likely to change.

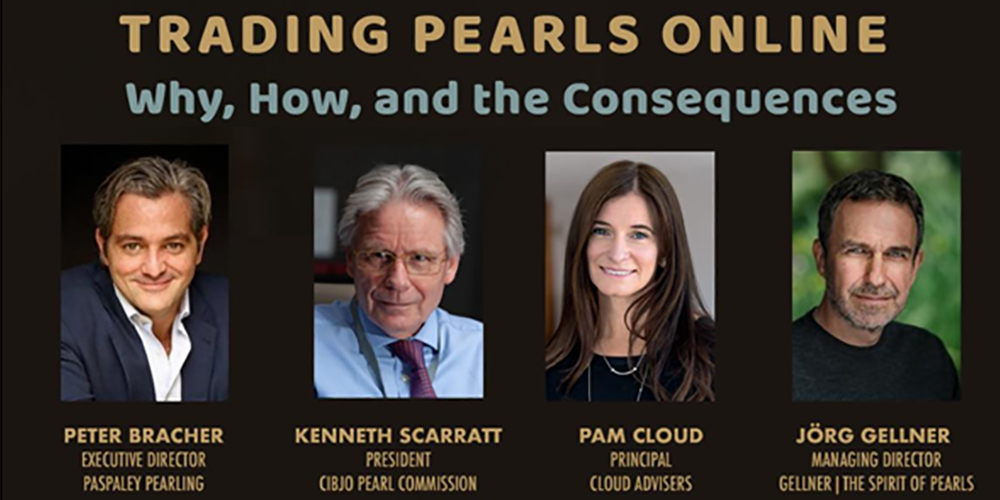

The bluechip panel includes Peter Bracher, Executive Director at Paspaley Pearling, the Australian company that is one of the world's most important pearl farmers and traders; Kenneth Scarratt, President of CIBJO's Pearl Commission, who is leading the World Jewellery Confederation's programme to create a universal and harmonised pearl grading system, and who also is the Managing Partner at the ICA Gem Lab in Bangkok, Thailand; Pam Cloud, Principal at Cloud Advisers, who formerly was Merchandising Vice President at Tiffany & Company in New York; and Jörg Gellner, Managing Director of Gellner, a prominent pearl jewellery designer and manufacturer based in Germany.

The seminar will be co-moderated by Edward Johnson and Steven Benson, and CIBJO President Gaetano Cavalieri will welcome participants.

The webinar is sponsored by Paspaley Pearling, which is also the Pearl Sponsor of Jewellery Industry Voices Season 3.